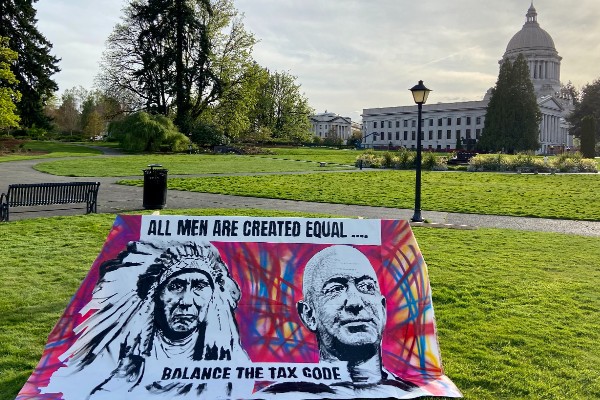

While most of us pitch in our share of taxes when we pay sales and property tax, the ultra-wealthy few are able to dodge taxes by funneling their wealth into tax-exempt holdings or the stock market. That's why taxing excessive wealth is an important step to balancing Washington's tax code, which is the most regressive in the nation.

Right now, the Washington State Legislature is considering House Bill 1406, which would create a tax on the ultra-wealthy that would raise $2.5 billion per year to be reinvested back into the community through essential services, which are under growing strain.

protecting essential services

The COVID-19 pandemic has driven even more people to seek services, while public investment in these services remains below pre-Recession levels.

Andrea Caupain Sanderson, CEO of Byrd Barr Place says, “In my 18 years at Byrd Barr, I’ve never seen this kind of demand for basic needs — not even close.” The impacts of both this disinvestment and the upside down tax code fall particularly hard on Black women in Washington. Andrea is calling on her state lawmakers to fund essential services through progressive revenue:

“Washington state can fund this spending with the untaxed wealth of the super rich and our hugely profitable corporations. Raising this revenue wouldn’t at all affect the lives of the wealthy, but it would allow our economy to roar back to life, save tens of thousands of families from poverty and help correct the shameful mistakes of the past.”

The availability of childcare for working parents also stands to increase with a new tax on the ultra-wealthy. Lois Martin, owner of Community Day Center for Children, spoke in favor of progressive revenue at a 2021 hearing of the Washington Legislature. She told lawmakers, "Having funds available to invest in Washington's early learning system is crucial to its sustainability and the state's overall economic recovery."

During yesterday's #WaLeg hearing Lois Martin made the case for #RevenueforRecovery: investing in our children and the frontline workers who care for them. Caregivers have had our back during this crisis, let's return the favor with HB1496. Email your rep: https://t.co/dru8RhRpAH pic.twitter.com/3cV9T0m90Z

— Civic Action (@civicaction) February 12, 2021

take action today

We shouldn’t have to fight over the critical services like childcare and senior centers that make for healthy neighborhoods. That’s why YWCA is fighting to pass HB 1406 and create a tax on the ultra-wealthy. You can help by sending a message of support to your lawmakers demanding that they put people first and pass HB 1406:

Eric Bronson is the Digital Advocacy and Engagement Manager at YWCA. He manages the Firesteel blog in addition to its social media streams and action initiatives. A graduate of Oberlin College, Eric focuses on the intersection of race and gender within the American political economy.

We tell the stories of those with lived experiences of racism and sexism and invite supporters to take concrete actions to correct the root causes of disparity in our communities.